BREKO Market Analysis 2021: Record investments in fiber optic expansion meet high demand among the population

BREKO Market Analysis 2021: Record investments in fiber optic expansion meet high demand among the population

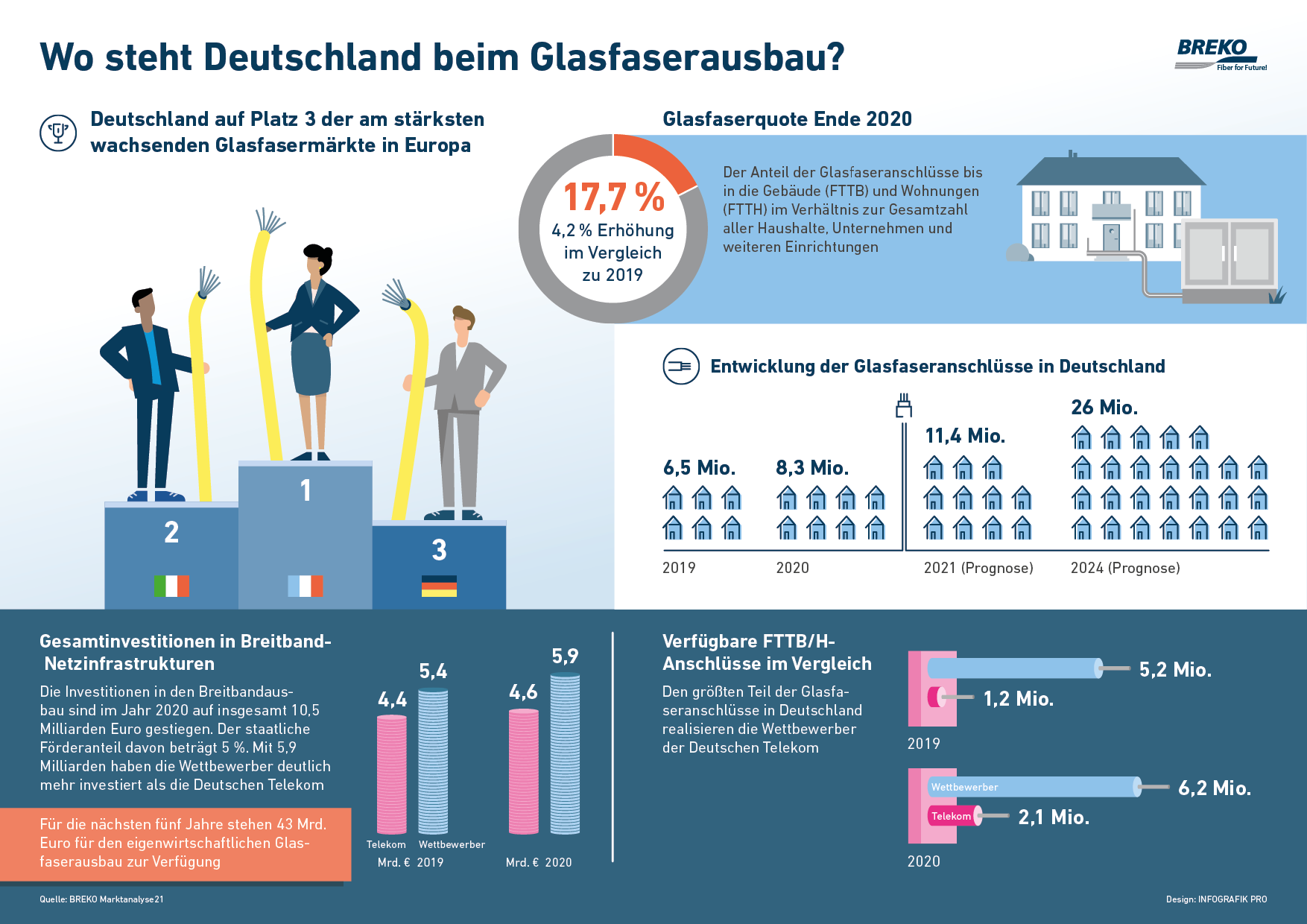

8.3 million fiber optic connections available, fiber optic share rises to 17.7 percent

Positive investment climate: €43 billion for network expansion by 2025

Demand for fiber optic connections continues to rise

Germany ranks third in Europe for fiber optic growth

Bonn/Berlin, 27 July 2021 Together with telecommunications expert and economist Prof. Dr. Jens Böcker, the German Broadband Association (BREKO) today presented its latest analysis on the status of fiber optic expansion in Germany. A positive development can be seen in all important key data. The continued rise in demand and ever-increasing growth in data consumption support the need to expand fiber optic networks as a future-proof and sustainable digital infrastructure. The high willingness to invest on the part of established and new market players will also ensure strong growth in fiber optic connections in the coming years. In order to further increase the rate of expansion, the next German government must continue to improve the framework conditions.

Prof. Dr. Jens Böcker, scientific director and author of the study, sees a positive development in fiber optic expansion that will continue in the coming years: “The BREKO market analysis shows that the most important key figures for fiber optic expansion are green: Demand for internet connections with high bandwidths has increased significantly, companies’ business models are working and companies and investors are providing the market with a great deal of capital. Five years ago, there were discussions about how to finance the expansion of fiber optics and which companies should finance it. Large-scale state funding programs were the answer. The need for this funding has been relativized by the new situation. This is a good basis on which the fiber optic network in Germany – with fair conditions for all market partners – can now be expanded faster and faster.”

Data consumption and demand for high bandwidths continue to rise

The significant increase in data consumption shows that the demands on the performance of the digital infrastructure are growing. The average fixed network data volume transmitted per connection and month increased by more than 40% last year. While a household consumed an average of 142 gigabytes in 2019, this figure rose to 200 gigabytes in 2020. An increase to 876 gigabytes per connection is expected for 2025. Despite the spread of 5G, mobile internet is no substitute for a landline internet connection: in 2020, almost 99% of all data per connection was still transmitted via the landline network.

According to BREKO market analysis surveys, demand for bandwidth will increase five- to six-fold over the next five years. For residential customers, this means an increase to 845 Mbit/s (download) and 302 Mbit/s (upload); for business customers, the bandwidth demand in 2026 will be 1.5 Gbit/s (download) and 922 Mbit/s (upload). The drivers for private customers are IPTV and streaming services, for business customers the implementation of cloud architectures. This trend is also reflected in the continued rise in demand for high-speed connections. A third of all customers already booked internet connections with a data rate of over 100 Mbit/s in 2020. More than one million customers have already opted for connections with data rates of 1 Gbit/s or more.

Accelerating increase in fiber optic penetration rate, positive expansion forecast for the coming years

The proportion of fiber optic connections to buildings and homes in relation to the total number of all households and companies (“fiber optic ratio”) rose to 17.7% at the end of 2020. This corresponds to an increase of 1.9 million to a total of 8.3 million fiber optic connections across Germany. This means that momentum has almost doubled compared to the previous year. At 6.2 million, the alternative network operators, i.e. Deutsche Telekom’s competitors, account for the majority of these connections.

The pace of expansion will continue to increase over the next few years: For the coming year, the BREKO Market Analysis 2021 forecasts an increase to almost 11.5 million fiber optic connections – 7.9 million of which will be implemented by alternative network operators. An increase to 26 million connections is expected by 2024. Of these, 16 million connections will be implemented by competitors and 10 million connections by Deutsche Telekom.

The number of booked fibre optic connections (“take-up rate”) in relation to the available connections increased to 43% despite the significant increase in new fibre optic connections at the network operators organized in BREKO. In addition, customer demand for fiber optic connections increased more strongly than for all other Internet access technologies such as cable or DSL. The growth in booked customer connections for fiber optics was 36%.

BREKO President Norbert Westfal is pleased with the development of the market, but also believes that companies have a responsibility to further increase the speed: “Last year, I said that the expansion of fiber optics had picked up speed. Today I can say that we have once again significantly accelerated the expansion and will keep our foot on the gas pedal. Germany’s growth rate for fiber optics is also well above average in a European comparison. We are now in third place here. Even though the fiber optic rate has increased twice as much as in the previous year, we will not rest on our laurels. We want to and will continue to increase the pace. However, we cannot do this alone: slow approval procedures are a bottleneck for the expansion of fibre optics, and their acceleration and digitalization must be consistently implemented locally. In the next legislature, the topics with overarching importance for digitalization, including digital infrastructure, must be bundled in a digital ministry.” In view of the increasing demand for fiber optic connections, the BREKO President is certain: “The constantly growing demand from customers is very important to us: Wherever fiber optic connections are available, they are increasingly being booked.”

High willingness to invest creates planning security for further fiber optic expansion

The willingness of companies to invest is high, as is the market dynamic – a number of new companies and investors are participating in the fiber optic expansion. Investments in digital infrastructure rose to a total of €10.5 billion in 2020, a record level. Alternative network operators also dominate here. Their investments of 5.9 billion correspond to 56% of the total investment volume. The financing of fiber optic expansion is also secured for the coming years. According to a BREKO market analysis forecast, at least EUR 43 billion will be available for the expansion of fiber optic networks in Germany over the next five years alone.

BREKO Managing Director Dr. Stephan Albers sees a paradigm shift in the expansion of the digital infrastructure: “The fiber optic market has developed to such an extent that it now stands on its own two feet and more and more citizens and companies in Germany can be offered a genuine fiber optic connection. The majority of these can be developed economically. The telecommunications market has changed fundamentally in terms of the “fiber optic business area”. The top dogs of copper and cable networks have relied on the existing infrastructures of the past for far too long. The “first movers”, the drivers of fiber optic expansion, are clearly the alternative network operators, 80 percent of which are BREKO companies. They are responsible for well over half of the fiber optic expansion. And they are also the creative designers of the expansion: whether open network access or the principle of pre-marketing – these instruments and expansion accelerators originate from the ideas of these companies. They have also championed modern installation methods from the very beginning.”

It is now important for further expansion progress to take advantage of the course set by the new Telecommunications Act. With a view to the upcoming federal elections, Albers appeals to politicians: “It is important that politicians formulate realistic and achievable expansion targets. Companies are not afraid to be measured against political targets, but these must be developed and implemented together with the telecommunications industry. A long-term expansion perspective is also an important signal to the construction industry, so that it becomes significantly more involved in fiber optic expansion and increases its investment in the necessary resources. The next federal government must introduce a prioritization in the further development of the ‘Grey Spots Funding Programme’ and use the tax funds in a targeted manner for those underserved areas that cannot be expanded economically. Based on the high willingness of companies to invest in their own expansion, this is both possible and necessary in order not to slow down the existing momentum.”

For the BREKO Market Analysis 2021, 201 network operators across Germany were surveyed in May 2021. In addition, data from publicly available sources was used for verification and to determine overall market figures. The research of the market data and the analysis of the survey results were carried out by the strategy consultancy Böcker Ziemen Customer Insight Consultants together with BREKO. You can download the BREKO Market Analysis 2021 here.

About BREKO

As the leading fibre association with more than 540 member companies, the German Broadband Association (BREKO) promotes competition in the German telecommunications market. Its members are clearly committed to future-proof fibre networks and are responsible for more than half of the deployment of fibre connections in Germany. In 2024, they invested 4.9 billion euros for this purpose. Further information can be found at brekoverband.de/en.